Ventura County Home Ready Mortgage 1% Down

What are HomeReady’s borrower benefits?

What are HomeReady’s borrower benefits?

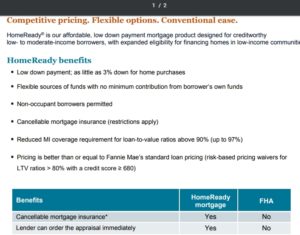

HomeReady serves low- to moderate-income borrowers, with expanded eligibility for financing homes

low-income communities. Some counties have no income limit (please call us to find out if you qualify).

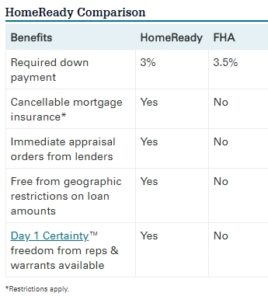

HomeReady features pricing that is better than or equal to standard loan pricing.Lower than standard MI coverage requirements for loans with LTVs greater than 90 percent up to 97 percent.

Cancellable monthly MI payments (per Servicing Guide policy; generally upon borrower request when

the loan balance drops below 80 percent LTV, or automatically when it drops below 78 percent).

Gifts, grants, and Community Seconds® can be used as a source of funds for down payment and closing

costs, with no minimum contribution required from the borrower’s own funds (1-unit properties). Any

eligible loan may have more than one Community Seconds (i.e., third lien) up to the maximum 105

percent CLTV (see Community Seconds fact sheet). Cash-on-hand can also be used for down payment

and closing costs (1-unit properties).

Unlike government-insured loans, with HomeReady, borrowers may have the option to cancel their mortgage insurance once their home equity reaches 20%. This can result in lower monthly payments down the road.

With HomeReady, cash for down-payment and closing costs can come from multiple sources, including gifts, grants, and Community Seconds ® – with no minimum personal funds required.

Max Loan Amount $453,100

Our 1% Down Home Ready Mortgage!

C2 Financial offers a loan program through one of our wholesale lenders that is only 1% down for a Home Ready Mortgage. Lower MI, Higher Debt To Income Ratio, Boarder Income Allowed, Primary Only and 1 unit only.

Max Loan Amount $453,100

CALL TODAY 310-291-1601

Connect

Connect with us on the following social media platforms.